non filing of income tax return notice under which section

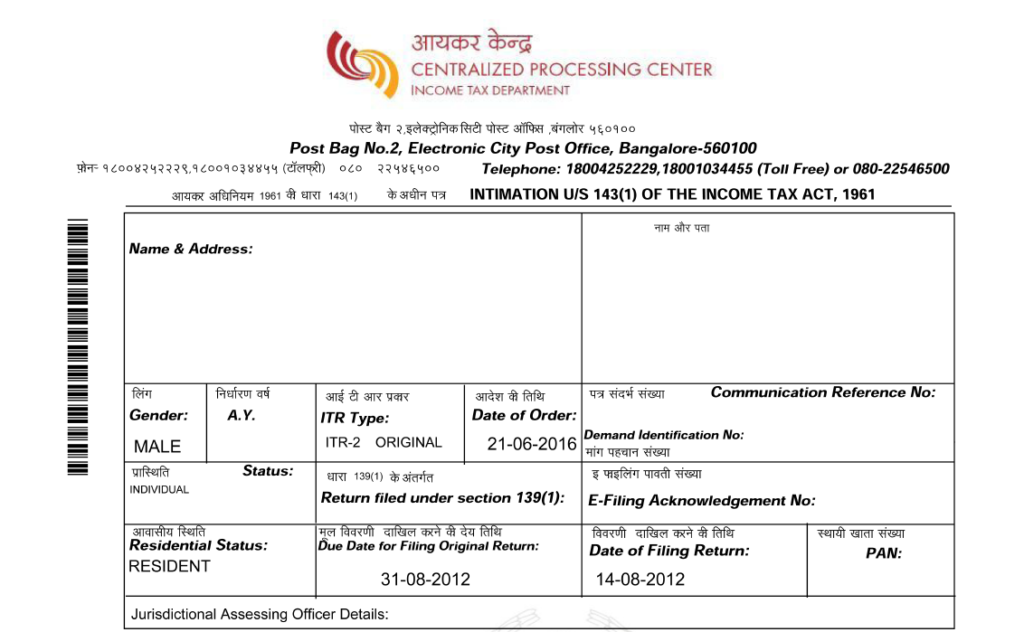

Income Tax Intimation Under Section 143 1 Learn By Quickolearn By Quicko How To Reply Notice For Non Filing Of Income Tax Return. Under the compliance tab click on View and Submit my Compliance option.

Here S What To Know About Filing For An Extension On Your Tax Returns Abc News

The income tax department may issue a notice under Section 271F for non-filing of IT Return.

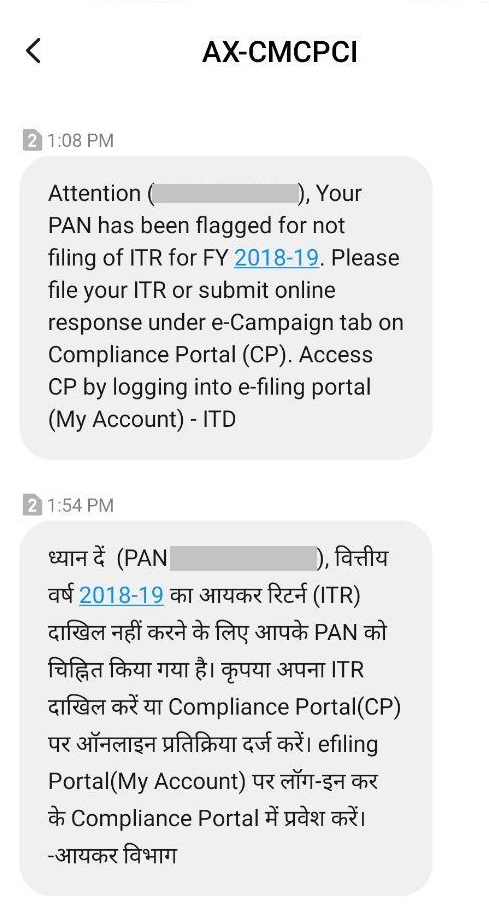

. Let us know in which section the notice is received and how to answer it. Income tax department has started sending notices to non-filers for the assessment year 2014-15. If you miss the due date for filing an income tax return you will receive a notice from the IT Department.

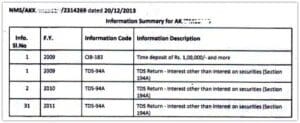

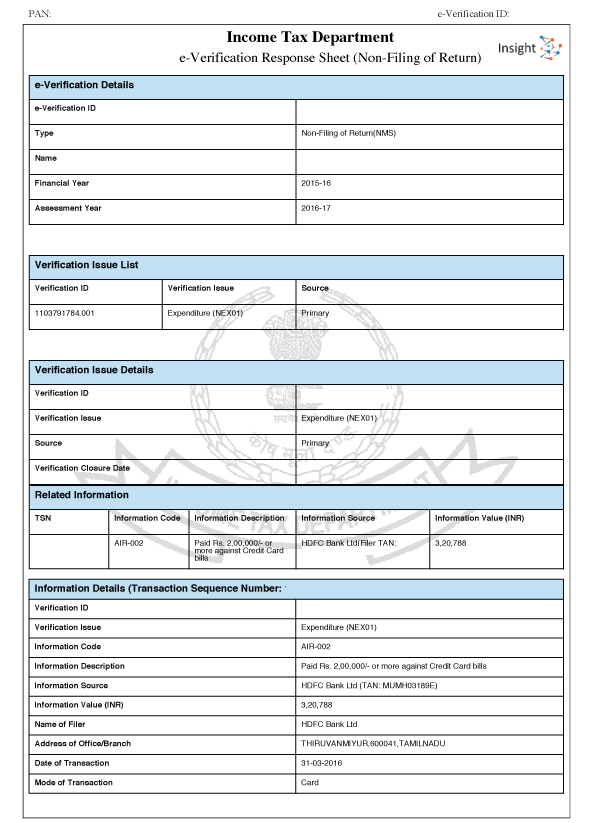

The income tax department has been capturing information on financial transactions activities relating to you through Non-filers Monitoring System NMS. Failure to file the return of income in response to a notice issued under section 1421i or section 148 or section 153A. What if belated return is not filed.

The Income Tax Dept collects information through various sources and then based on their own analysis send notices to people who have carried out specified transactions. If the Income Tax return is not furnished by the assessee within the timeframe underlined in the notice issued under Section 148 by the presiding Assessing Officer the assessee shall be made to pay interest under Section 2433 for late filing of Income Tax return or for not filing of Income Tax return if the income has already been determined under Section. If the 4506-T information is successfully validated tax filers can expect to receive a paper IRS Verification of Nonfiling letter at the address provided on their request within 5 to 10 days.

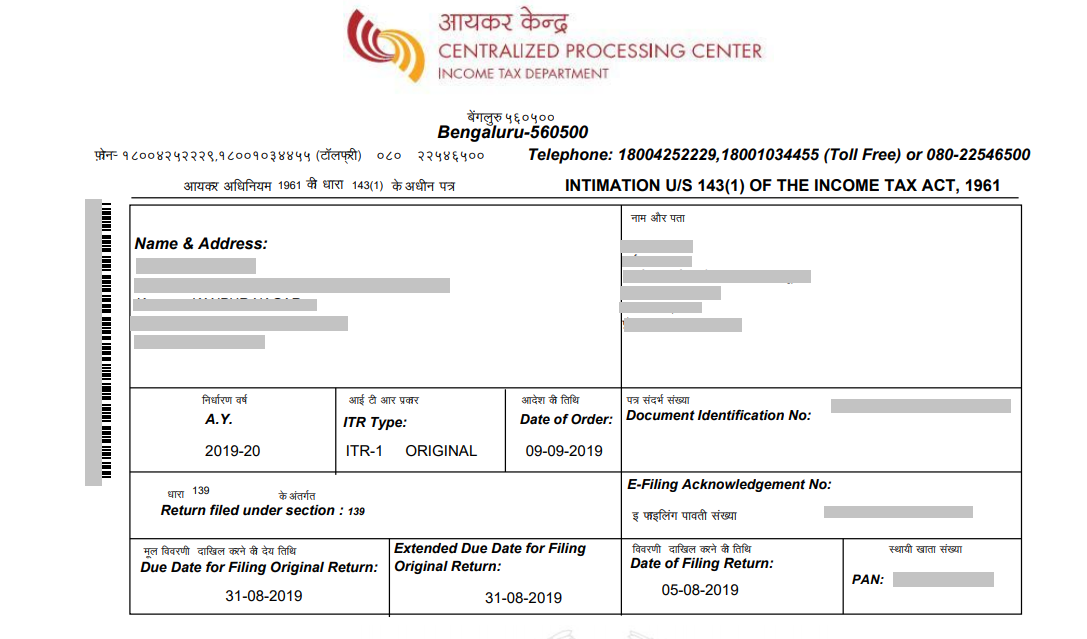

If you have a genuine explanation for not filing and if the officer is satisfied with the reason you may not have to pay the penalty. The Due Date to file Original Income Tax Return under Sec 139 1 is 31st July from the end of the financial year if tax audit is not applicable. If the taxpayer does not respond within that timeframe to the income tax notice under section 1431.

These notices can be for investigation non-filing delay in filing ITR non-disclosure of income and non-payment of self-assessment tax. Rigorous imprisonment which shall not be less than 6 months but which may extend to seven years and with fine where tax sought to be evaded exceeds Rs. As per the provisions of sec 139 1 of the income tax act 1961 any.

Section 1432 Notice under this section is received after a detailed enquiry has been done by the assessing officer. You may have to pay a penalty of up to Rs. How To Respond To Non Filing Of Income Tax Return Notice All About Notice U S 143 1 A And How To Deal With It Myitreturn Help Center.

The income tax department may issue a notice under Section 271F for not filing ITR. Here you can view information about your non-filing status. The previous year to be counted is required to be the one whose return filing date under sub-section I of section 139 has expired.

A He has not furnished the return of income for the assessment year relevant to the previous year immediately preceding the financial year in which tax is required to be deductedcollected. All groups and messages. 5000 for missing the deadline.

5000 for missing the deadline. Section 1431 under this section the taxpayer receives a notice if an adjustment or additional tax needs to be paid or there was some incorrect information provided or there was a calculation error. How to handle notice received for Non-Filing of Income Tax Return Asst Year 2013-14.

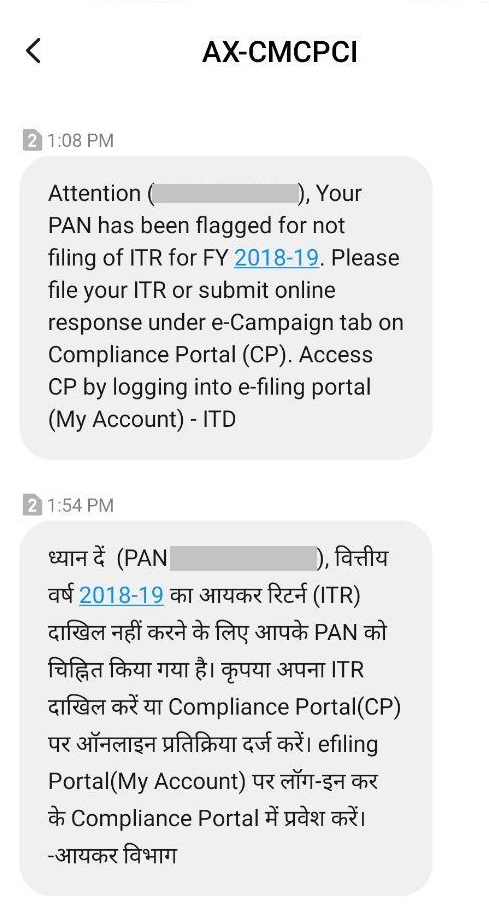

Compliance Income Tax Return filing Notice This notice is sent to people by the Income Tax Dept if they think that the person has some taxable income but the ITR has not been filed for such income. You can find another option view my submission. 1 lakh upto 30-6.

See IRM 20123 Failure to File a Tax Return -. Click on Compliance Menu Tab. Failure to file the return of income as per section 1391.

Section 139 of the income tax act 1961 deals with the different kinds of. However the due date is 30th September from the end of the financial year if the tax audit is applicable. Submit the letter to the financial aid office.

This notice is about some dues which the tax payer owes to the department. Suppose the taxpayer wishes to amend the income tax return after receiving a section 143 1 income tax note. This revenue procedure provides the 2023 inflation adjusted amounts for Health Savings Accounts HSAs as determined under 223 of the Internal Revenue Code and the maximum amount that may be made newly available for excepted benefit health reimbursement arrangements HRAs provided under 549831-1c3viii of the Pension Excise Tax.

If you have a genuine explanation for not filing and if the officer is satisfied with the reason you may not have to pay the penalty. Under this section details of non-filing of Income tax returns will be furnished. Furnish the appropriate reasons for not filling the Income Tax Returns.

Upon successfully log in to the account click on the Compliance Tab. If there is any discrepancy in your income tax return you can get a notice under several sections of the Income Tax Act. In that case The taxpayer must be aware that the deadline to revise the return is 15 days after receiving the notice.

IRC 6651a1 imposes a penalty for failure to file a tax return by the date prescribed including extensions unless it is shown that the failure is due to reasonable cause and not due to willful neglect. Mail or Fax the Completed IRS Form 4506-T to the address or FAX number provided on page 2 of form 4506-T. You may have to pay a penalty of up to Rs.

Click on View and Submit Compliance to submit your response to the non-filing compliance notice. Notice under section 1421 After filing Income tax return if the assessing officer require additional information then income tax notice under section 1421 is issued in case of non-filing of return a notice under section 1421 is issued mentioning to file the return before the date as mentioned in the notice. If the assessing officer feels some income has been missed a notice is sent under this section as the income will need to be reassessed.

Self Assessment Deadlines Money Donut

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

How Should You Respond To A Defective Income Tax Return Notice Under 139 9

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

Understand Income Tax Notices Learn By Quickolearn By Quicko

How To Respond To Non Filing Of Income Tax Return Notice

All You Need To Know About Income Tax Notice Paisabazaar Com

All You Need To Know About Income Tax Notice Paisabazaar Com

How To Respond To Non Filing Of Income Tax Return Notice

Income Tax Assessment Taxbuddy

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

How To Respond To Non Filing Of Income Tax Return Notice

How To Handle Income Tax It Department Notices Eztax

Income Tax India On Twitter Govt Extends Timelines Of Certain Compliances To Mitigate The Difficulties Faced By Taxpayers Due To The Ongoing Covid 19 Pandemic Cbdt Issues Circular No 08 2021 Dated 30 04 2021 U S

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

Notice For Not Filing Income Tax How To Respond To It Learn By Quickolearn By Quicko

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)